Business Insurance in and around Lawrenceville

Searching for coverage for your business? Search no further than State Farm agent Gabe Gomez!

No funny business here

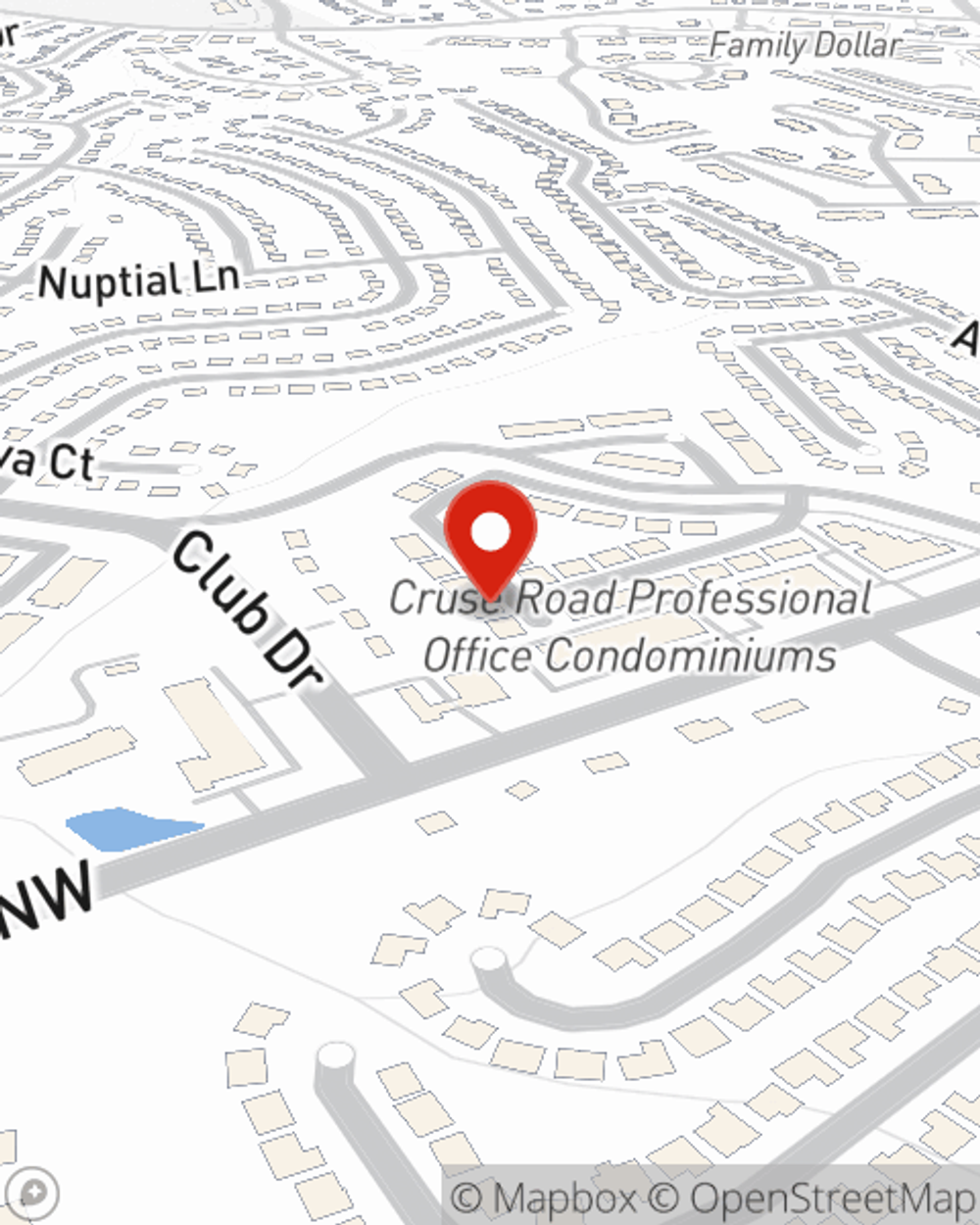

- LAWRENCEVILLE

- LILBURN

- NORCROSS

- BUFORD

- DACULA

- BRASELTON

- HOSCHTON

- PENDERGRASS

- JEFFERSON

- FLOWERY BRANCH

- GAINESVILLE

- WINDER

- GRAYSON

- LOGANVILLE

- SNELLVILLE

Business Insurance At A Great Value!

You've put a lot of elbow grease into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a HVAC company, a stained glass shop, a toy store, or other.

Searching for coverage for your business? Search no further than State Farm agent Gabe Gomez!

No funny business here

Get Down To Business With State Farm

Every small business is unique and faces a wide array of challenges. Whether you are growing a dental lab or a shoe store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Gabe Gomez can help with extra liability coverage as well as professional liability insurance.

Let's talk business! Call Gabe Gomez today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Gabe Gomez

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.